Dividend Update - February 2017

|

| Dividend growth investing is a simple, straight-forward strategy for the average Joe investor. |

The middle month of each quarter is kind of like the middle child for my dividend payments. You love them for sure, but it's kind of constantly overlooked due to not being the first month of a new quarter or the larger paying third month of each quarter. Nevertheless, the dividends received in the mid-quarter month spend the same as any other dividends.

During February my FI Portfolio delivered $274.29 in dividends. I also received $1.36 within my Loyal3 Portfolio bringing my total taxable account dividends up to $275.65. My Roth IRA is always noticeably absent with the mid-quarter payout and provided $0 in dividends. Across all 3 accounts, excluding the effect of taxes, I received $275.65 in dividends during February. Year to date all 3 portfolios have provided $576.35.

FI Portfolio

Just looking at the numbers as they are there seems to be some mixed signals compared to the prior quarter and year over year. February's dividends showed a 3.3% increase from November, but an 11.8% decline year over year. Last year was a year of some adjustments for my portfolio so a deeper look is warranted.

The quarter over quarter comparison doesn't give a fair picture since Starbucks Corporation (SBUX) (Analysis Here) decided to move their November payment to December last year. So February's dividends are artificially high. The only other change is from YUM! Brands (YUM) that decreased their portion of the dividend payment after spinning off YUM! China (YUMC). Normalizing the dividends, i.e. only comparing dividends that were paid in both periods, showed a 1.5% increase quarter over quarter.

I'm much more interested to see why the year over year decline was up near 12%. Aside from the aforementioned YUM! Brands the other culprit here was HCP, Inc. (HCP). If you recall HCP was running into a lot of issues with HCR Manorcare and ultimately decided it needed to spin it off via a new company, Quality Care Properties (QCP). I decided to sell my stake in HCP prior to the spin-off because if management felt they needed to get rid of those properties I didn't want to own them via the spin-off. There were also signs that HCP was going to decrease the overall dividend payment during the spin-off bringing an end to their dividend growth streak. I figured it was best to be out of the position altogether and then reassess after I see how HCP does without that albatross weighing them down.

Normalizing the dividend payments to account for HCP and YUM! Brands moves the year over year comparison jumps to a solid 6.8% increase.

Loyal3 Portfolio

My Loyal3 Portfolio had very little to report with just one small dividend payment from Apple (AAPL). Luckily though the reporting here is fairly straightforward since there were no changes from November. Quarter over quarter my Loyal3 dividends showed no change while year over year they increased 9.7%.

Roth IRA Portfolio

My Roth IRA remained on the outside looking in for the mid quarter month. There were no dividends received in February within my Roth IRA. For comparison purposes both the quarter over quarter and year over year change was nil.

Dividend Raises During the Month

February was a great month for dividend raises with a total of 7 of my FI Portfolio holdings boosting up their payouts. These raises came from a wide cross-section of the economy including two consumer staples, two discount retailers, an industrial conglomerate and two financials. All told the 7 announced increases raised my forward 12-month dividends by a combined $42.82.

Through the first two months of 2017 I've received 10 increases that have increased my forward 12-month dividends by $61.39. That's more income coming my way each year all because the younger me had the foresight to purchase shares in excellent companies.

Looking Forward

My forward 12-month dividends for my FI Portfolio are up to $5,604.36. Forward dividends in my Loyal3 Portfolio ended the month at $69.09 bringing the total taxable account forward dividends to $5,673.45. My Roth IRA's forward 12-month dividends increased to $283.30 thanks entirely to the addition of McCormick & Company (MKC) to the portfolio.

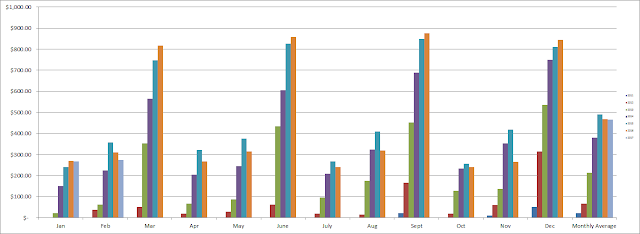

Monthly Average

Below is the chart showing the monthly dividend totals for each year that I've been investing as well as the monthly average. It's not always an increase as some companies have weird payout schedules and eventually some positions will get dropped, but the long-term trend is what matters. Over the TTM our monthly average is at $465.34.

|

| My real-life financial independence portfolio's monthly dividend history. |

| Company | Dividend Amount | DRIP Shares |

|---|---|---|

| The Procter & Gamble Company (PG) | $45.80 | -- |

| AT&T Inc. (T) | $25.03 | -- |

| Air Products & Chemicals (APD) | $15.89 | -- |

| Realty Income Corporation (O) | $19.30 | 0.316 |

| General Mills, Inc. (GIS) | $31.33 | -- |

| Verizon Communications (VZ) | $24.83 | -- |

| Starbucks Corporation | $14.05 | -- |

| YUM! Brands, Inc. | $12.63 | -- |

| Deere & Company (DE) | $36.15 | -- |

| Omega Healthcare Investors (OHI) | $49.28 | 1.580 |

| February 2017 Total | $274.29 | |

| 2017 YTD Total | $541.14 |

| Company | Dividend Amount | DRIP Shares |

|---|---|---|

| Apple Inc. | $1.36 | -- |

| February 2017 Total | $1.36 | |

| 2017 YTD Total | $10.05 | -- |

I've updated my Dividend Income page to reflect February's changes.

Two months into the year how are you doing on your goals?

Please share your thoughts below!

Image courtesy of Stuart Miles on FreeDigitalPhotos.net.

Yet another solid month of dividends, JC. Congrats and keep up the good work. Thx for sharing

ReplyDeleteR2R

Another solid month, congrats to you. Seems a lot of people are getting a smaller month in February, but this should mean a larger March right? We will see.

ReplyDeleteStill a very solid showing for the month of February despite YUM's reduced payout after the spin off and HCP's change of schedule. Those two companies affected many, many portfolios of our peers. Keep up the good work. You hold a lot of stable dividend payers.

ReplyDeleteThis is great JC. Your portfolio is doing great despite the small hiccup. In a long term perspective these hiccups will not even be seen. Great month and thanks for sharing.

ReplyDelete