Recent Option Transaction

|

| Digital Realty (DLR) Nov 18 $80 Strike Put Option |

Over the last couple weeks many higher yield companies have seen their share prices pull back 5-10%. My guess is that's partially related to interest rate hike fears, but I can't help but think it's also due to the over-exuberance for anything with a yield that had pushed valuations to pretty lofty levels. Whatever the reason we have to deal with where we're at now though.

I'm still not too excited about putting capital to work in the markets directly so I've been heading to the options market to get exposure that way. The great thing about selling put options is that if done correctly you get the best of both worlds where you can earn a synthetic dividend or you get to purchase shares at a discount.

Digital Realty Trust (DLR) is one of those companies I've long sought after, but haven't been able to add to my portfolio for various reasons. From 9/28 to 10/7 Digital Realty's share price has declined over 8% despite no significant news coming out. Luckily for me that means the option premiums are a bit juiced due to the recent volatility.

What'd I Do?

On Friday I sold to open 1 put contract on Digital Realty Trust.

Let's go over the pertinent details and then move on to the various ways this can play out.

Company: Digital Realty Trust (DLR)

Date Opened: 10/7/2016

Expiration Date: 11/18/2016

Strike Price: $80.00

Price of Contract: $0.60

Premium Received less Commission/Fees: $52.00

Share Price at Time Contract Sold: ~$91.40

How can this play out?

For those that don't know much about options I'll cover the general gist of a put option. Essentially I'm selling someone the right to sell me 100 shares of a company at an agreed upon price, the strike price, on or before the contract expiration date. However, I'm not going to just do that for free so I receive the option premium up front. Think of the option premium as an insurance premium payment.

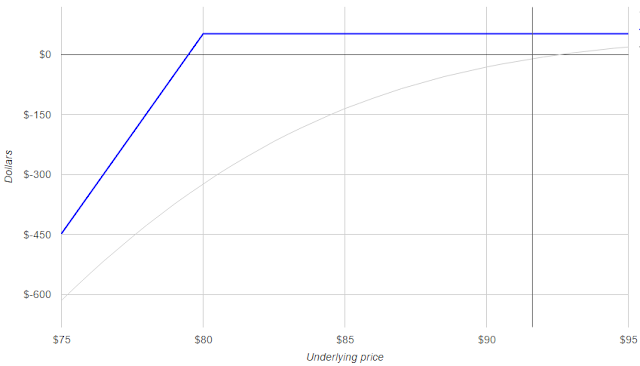

If the share price stays above the strike price, $80, then the put option would be out of the money and therefore unexecutable. So I would just keep the premium and go on the look for other places to invest my capital. On the $8,000 in cash that the contract represents that's a solid 0.65% return. On an annualized basis that works out to a 5.65% return.

Of course the share price could keep declining and if it drops below $80.00 then I would likely have to purchase the shares for $80.00 per share. That would suck; however, the option premium actually gives me further downside protection. If I have to purchase the shares my effective purchase price would be $79.48. So I'd get to purchase the shares at a 13.0% discount to the share price when I sold the contract.

In my book that's a win win.

There's one other scenario that can play out and that's if Digital Realty's share price makes a big move higher prior to the expiration date. In that case I would likely buy back my put option to close out the position and lock in the remaining premium.

In graphical form this is how the put option looks.

|

| Digital Realty Trust (DLR) November 18, 2016 $80 Strike Put Option Profit/Loss Graph |

Like I mentioned earlier I'm a big fan of Digital Realty. In case you don't know much about them they are a real estate investment trust that specializes in data centers. The combination of fast growth technology and stable real estate sounds like a great situation to me.

Even though I'd love to add shares of Digital Realty to my portfolio, cash is a bit tight so just collecting option premiums is my preferred way for this to work out. Although if I do have to purchase the shares that's fine by me.

At my purchase price of $79.48 Digital Realty would need to grow the dividend at just 3.4% per year to justify an 8% rate of return. For a 10% return the dividend only needs to grow at 5.3% per year. Even better is that in late July management announced another solid earnings report and boosted its 2016 guidance to $5.65-5.75 FFO per share. My purchase price would be for a P/FFO between 13.8-14.1 based on managements guidance range.

So yeah, I'm happy either way this works out.

I've updated my Option Summary page to reflect this change.

Do you incorporate an option strategy with your portfolio by selling covered calls or writing puts?

Please share your thoughts below!

Image source

I think is a really great strategy given where the market is. I've been thinking of writing some puts on MO. DLR is also a stock on my watchlist as well. Great post!

ReplyDeleteGreg,

DeleteI'm leaning more towards doing options on dividend growth companies as my base strategy as opposed to just outright purchases. Obviously though that's only if the valuations are elevated, as I feel they are right now. Normally I'd probably be a bit more aggressive on that with a tighter strike price, but cash is a bit tight so I needed more downside protection.

All the best.

It looks like you paid about 8 bucks a contract for your options trade. Better pricing is available at Options House and Interactive Brokers. I use IB and like it best.

ReplyDeleteFV,

DeleteYeah I'm in the process of trying to move cash over to my second brokerage and I'm likely rolling my 401k over to an IRA at IB. I'd love to get more assets over at IB but I'm going to start with just the IRA and see how things go. Got to love those low commissions.

Thanks for stopping by!