Dividend Growth Investing at Work - Early Announcements Are Fun

|

| Getting a pay raise while sitting on the couch? Sign me up! Thanks AT&T for another raise! |

Lots of news to report regarding AT&T (T). For starters I have a new option position open that I hope to detail tomorrow. But the big news for investors was the huge $100 B M&A activity announced with Time Warner. Based on the reaction to AT&T's share price investors aren't exactly celebrating the Time Warner deal; however, there was something that should make investors happy that was a bit hidden by the M&A deal: a dividend increase.

The increase was definitely unexpected at this time and I wasn't on the lookout for one from AT&T...yet. Since 1995 this payment has been declared in early December every year except one and that was in November. So my gut tells me that management wasn't sure how shareholders would greet the Time Warner deal and moved the dividend announcement up as a way to generate a bit of "goodwill" with investors in case they didn't exactly applaud the M&A.

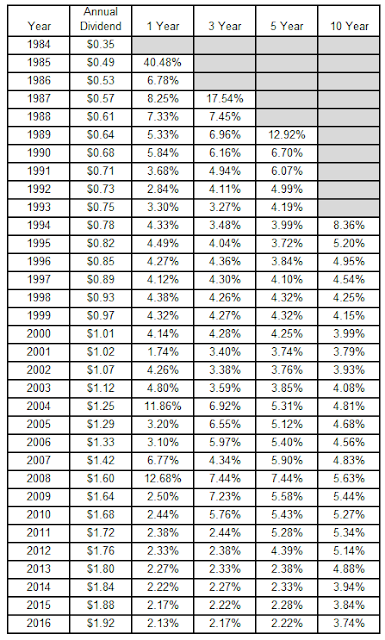

On Saturday, October 22nd the Board of Directors at AT&T announced a dividend increase boosting the dividend from $0.48 to $0.49. That's another 2.1% raise. AT&T is a Dividend Champion with 33 consecutive years of dividend growth. Shares currently yield 5.32%.

Since I own 51.088 shares of AT&T in my FI Portfolio this raise increased my forward 12-month dividends by $2.04. This is the 6th dividend increase I've received from AT&T since initiating a position in late 2011. Cumulatively my income from AT&T has increased by 14%!!! According to USInflationCalculator the total rate of inflation over the same time period is just 7.3%. So AT&T is growing my income nearly twice as fast as inflation.

A larger version of the chart can be found here.

AT&T has consistently given increases; however, the growth hasn't been anything you'd brag about. Investors haven't received more than a token $0.01 boost to their dividend since 2007. As such the dividend growth rate has been stuck at 2% on an annual basis since then. Luckily for investors the dividend yield is routinely in the 4-6% range so dividend growth doesn't have to be high to generate decent returns from a stable business.

| |

|

Wrap Up

My forward dividends increased by $2.04 with me doing nothing. That's right, absolutely nothing to contribute to their operations. Based on my portfolio's current yield of 3.04% this raise is like I invested an extra $67 in capital. Except that I didn't! One of the companies I own just decided to send more cash my way.

That's how you can eventually reach the crossover point where your dividends received exceed your expenses. That's DIVIDEND GROWTH INVESTING AT WORK! The beauty of the dividend growth investing strategy is that you build up your dividends through fresh capital investment as well dividend increases from the companies you own.

For a dividend growth investor there's not much better than hearing news of a dividend increase. So far this year I've received 44 increases from 35 companies increasing my forward 12-month dividends by $252.77.

My FI Portfolio's forward-12 month dividends increased to $5,394.99 and including my Loyal3 portfolio's forward dividends of $65.40 brings my total taxable account forward dividends to $5,460.39. My Roth IRA's forward 12-month dividends remained at $240.84.

Previous Raises this Month:

Omega Healthcare Investors (OHI)

Visa, Inc. (V)

Expected Raises in October:

Aflac (AFL)

Starbucks (SBUX)

Do you own shares of AT&T? Were you a bit surprised by the dividend announcement in October? What do you think of the Time Warner merger?

Please share your thoughts below.

Image courtesy of digitalart on FreeDigitalPhotos.net.

PIP -

ReplyDeleteAlways pumped to see your posts here and the relation to inflation to see if you're beating it/the div increases beat it. Great stuff here and was definitely caught off guard when they increased it as well. BUT, no shock to the $0.01 per quarter increase haha. Keeping the streak alive though!

-Lanny

Lanny,

DeleteThe amount of the raise was completely expected but I can't help but wonder why exactly the announcement came so much earlier than normal and on a Saturday at that. It's always great to see how the real organic dividend growth stacks up with the inflation that we've seen over the same time. Luckily every position I own is ahead of inflation!

Thanks for stopping by!