The Best of Both Worlds: Put Options

Obviously the most important part about investing is finding the truly great companies that have the ability to grow profits and dividends for decades on end. Once you identify those companies through a qualitative analysis the next step I like to take is a fundamental analysis to determine what a "fair value" for the company's shares is. After you determine what price you'd be willing to pay for the future growth and income stream that a company provides you can see where the current share price lies on the value spectrum, i.e. whether shares are under, fairly, or over valued. There's two ways to enter into a position, you can either purchase shares outright or you can write/sell put options. My preferred method is open market purchases but sometimes the value just isn't there and put options give

By selling a put option you are selling someone the right to sell shares of a company at a predetermined price. Now no one is going to give up their "option" for free so in return the seller receives an option premium. We'll use Coca-Cola (KO) (Full Analysis Here) since shares are currently trading for about a 1.50% premium to my fair value calculation of $40.75. If I'm a stickler for not paying more than what I deem to be a fair value price then Coca-Cola wouldn't be a possibility right now unless I use put options. Let's look at the options that expire September 26th.

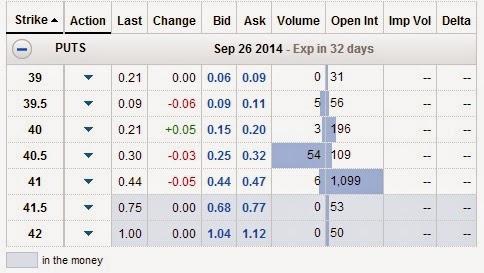

This is the option table for Coca-Cola as of around 1:15 PM yesterday.

Definitions:

Strike or Strike Price - The price that determines whether an option can be executed or expire worthless. In the case of put options if shares are trading below the strike price the option can be executed. If shares are trading above the strike then the option expires.

Bid - The amount that buyers are offering for that option.

Ask - The amount that sellers are asking for that option.

Expiration or Expiration Date - The date at which the option expires.

Write an option - The seller of the option.

Buy an option - The buyer of the option.

In the money - Option would be executed if the expiration was today. In the case of put options the current share price is lower than the strike price.

Out of the money - Option would expire worthless if the expiration was today. In the case of put options the current share price is higher than the strike price.

Each option contract represents 100 shares.

Example:

Like most things there's more than one way to skin a cat so to speak. I'll run through the calculations for one of the options and then give a summary of all of the options at the end. Let's look at the $40.50 strike price since that is the closest to my fair value price of $40.75. I'll assume commission costs from my brokerage firm of $7.95 + $0.75 ($8.75) per contract and we'll sell just 1 contract representing 100 shares. All calculations will be based off the prices from above with a sell date of August 25th and an expiration date of September 26th and assume that you are selling to open the put option.

When you sell the option you receive an option premium upfront and can use that capital right away. In the above case of the $40.50 strike price the bid is $0.25 and the ask is $0.32. We'll assume that you sell to open the put option at $0.29 which is about halfway between the bid and ask. The option premium that you would see deposited in your bank account would be $0.29 * 1 contract * 100 shares per contract - $8.75 commission = $20.25. Since standard stock option contracts in the United States can be executed anytime they are in the money, your brokerage will require you to have enough cash in your account to cover the option if it's executed. In this case the cash requirement would be $40.50 strike * 1 contract * 100 shares per contract - $20.25 option premium = $4,050.00. If the share price is trading higher than the strike price of $40.50 (i.e. out of the money) then you would get to keep the full option premium as profit. Your percentage return would be $20.25 / $4,050.00 = 0.50% which is equivalent to an annualized return of 5.73%.

I also like to calculate what my cost basis would be if the option is executed. That way I know what price I'm effectively paying for the shares. In the case of the $40.50 strike put the per share cost basis would be calculated at follows $40.50 strike * 1 contract * 100 shares per contract - $20.25 option premium + $7.95 standard commission = $40.38. My brokerage charges the base purchase commission of $7.95 if the option is executed.

The following is the information I like to look at for each option combination.

You'll notice that the option premium declines the further out of the money the strike price is. That makes sense because it would require a nearly 5% decline for the $39.50 strike put to be exercised. For a company as stable as Coca-Cola those kinds of price swings aren't all that common over any given one month period. As the strike price gets closer to the current price the option premium increases. At strike prices above the current price the option premiums offer great returns but will most likely end up being executed.

Conclusion:

You have to balance your desire for a solid return if the option expires worthless with the cost basis if the option is executed. It's important to balance the risk/reward, well the way I look at it the reward/reward. My strategy when selling put options is to try to find combinations that give a 10%+ annualized return if the option expires worthless (out of the money) and a cost basis I'd be happy to buy shares at on the open market if the option is executed (in the money).

If you are comfortable paying fair value for a solid company like Coca-Cola then the $41 strike put could be intriguing. It offers a solid 10.46% annualized return if it expires and a $40.71 cost basis if it's executed. That's a pretty good trade-off between the two outcomes. The one big factor against selling puts is that it puts a hold on a large chunk of capital. With the $41 strike put you would need $4,100.00 set aside

Selling put options can be a great way to both generate extra income from your capital or to purchase shares at lower prices than are currently offered in the market. You can even use margin to reduce the capital outlay but that introduces a whole set of risks and issues. If you have capital lying around waiting to be invested and specific companies in your target for purchase then selling put options can offer the best of both world.

Here is a link to a calculator so you can make your own calculations and see different scenarios.

By selling a put option you are selling someone the right to sell shares of a company at a predetermined price. Now no one is going to give up their "option" for free so in return the seller receives an option premium. We'll use Coca-Cola (KO) (Full Analysis Here) since shares are currently trading for about a 1.50% premium to my fair value calculation of $40.75. If I'm a stickler for not paying more than what I deem to be a fair value price then Coca-Cola wouldn't be a possibility right now unless I use put options. Let's look at the options that expire September 26th.

This is the option table for Coca-Cola as of around 1:15 PM yesterday.

Definitions:

Strike or Strike Price - The price that determines whether an option can be executed or expire worthless. In the case of put options if shares are trading below the strike price the option can be executed. If shares are trading above the strike then the option expires.

Bid - The amount that buyers are offering for that option.

Ask - The amount that sellers are asking for that option.

Expiration or Expiration Date - The date at which the option expires.

Write an option - The seller of the option.

Buy an option - The buyer of the option.

In the money - Option would be executed if the expiration was today. In the case of put options the current share price is lower than the strike price.

Out of the money - Option would expire worthless if the expiration was today. In the case of put options the current share price is higher than the strike price.

Each option contract represents 100 shares.

Example:

Like most things there's more than one way to skin a cat so to speak. I'll run through the calculations for one of the options and then give a summary of all of the options at the end. Let's look at the $40.50 strike price since that is the closest to my fair value price of $40.75. I'll assume commission costs from my brokerage firm of $7.95 + $0.75 ($8.75) per contract and we'll sell just 1 contract representing 100 shares. All calculations will be based off the prices from above with a sell date of August 25th and an expiration date of September 26th and assume that you are selling to open the put option.

When you sell the option you receive an option premium upfront and can use that capital right away. In the above case of the $40.50 strike price the bid is $0.25 and the ask is $0.32. We'll assume that you sell to open the put option at $0.29 which is about halfway between the bid and ask. The option premium that you would see deposited in your bank account would be $0.29 * 1 contract * 100 shares per contract - $8.75 commission = $20.25. Since standard stock option contracts in the United States can be executed anytime they are in the money, your brokerage will require you to have enough cash in your account to cover the option if it's executed. In this case the cash requirement would be $40.50 strike * 1 contract * 100 shares per contract - $20.25 option premium = $4,050.00. If the share price is trading higher than the strike price of $40.50 (i.e. out of the money) then you would get to keep the full option premium as profit. Your percentage return would be $20.25 / $4,050.00 = 0.50% which is equivalent to an annualized return of 5.73%.

I also like to calculate what my cost basis would be if the option is executed. That way I know what price I'm effectively paying for the shares. In the case of the $40.50 strike put the per share cost basis would be calculated at follows $40.50 strike * 1 contract * 100 shares per contract - $20.25 option premium + $7.95 standard commission = $40.38. My brokerage charges the base purchase commission of $7.95 if the option is executed.

The following is the information I like to look at for each option combination.

You'll notice that the option premium declines the further out of the money the strike price is. That makes sense because it would require a nearly 5% decline for the $39.50 strike put to be exercised. For a company as stable as Coca-Cola those kinds of price swings aren't all that common over any given one month period. As the strike price gets closer to the current price the option premium increases. At strike prices above the current price the option premiums offer great returns but will most likely end up being executed.

Conclusion:

You have to balance your desire for a solid return if the option expires worthless with the cost basis if the option is executed. It's important to balance the risk/reward, well the way I look at it the reward/reward. My strategy when selling put options is to try to find combinations that give a 10%+ annualized return if the option expires worthless (out of the money) and a cost basis I'd be happy to buy shares at on the open market if the option is executed (in the money).

If you are comfortable paying fair value for a solid company like Coca-Cola then the $41 strike put could be intriguing. It offers a solid 10.46% annualized return if it expires and a $40.71 cost basis if it's executed. That's a pretty good trade-off between the two outcomes. The one big factor against selling puts is that it puts a hold on a large chunk of capital. With the $41 strike put you would need $4,100.00 set aside

Selling put options can be a great way to both generate extra income from your capital or to purchase shares at lower prices than are currently offered in the market. You can even use margin to reduce the capital outlay but that introduces a whole set of risks and issues. If you have capital lying around waiting to be invested and specific companies in your target for purchase then selling put options can offer the best of both world.

Here is a link to a calculator so you can make your own calculations and see different scenarios.

Dear PIP

ReplyDeleteThank you for this post, which for me is a difficult subject to understand. As I see it you get $20.24 if the Coke option expires. So money for free.

If you bought the the Coke shares your total cost would be $4070.25. $20.24 divided by $4070.24 = 0.51%. A negligible margin.

My question is, Why would somebody want to do this?

Kind regards

Louis Gunn

Louis,

DeletePut options can be a great way to generate extra income. This isn't the greatest example because I'll usually try and get a bigger difference between the outright purchase and put option execution. If you have capital that you want to invest but want a cheaper price you're effectively setting a limit order but get paid until it hits. I've done pretty well with put options and gave added over $1k from premium collections this year. Not bad for about $5-6k in capital.

Thanks for stopping by!

HI JC

ReplyDeleteGreat article explaining how you can use Put options to lower your cost to purchase a company, do you also use covered Call options for generating income on your current holdings?

I haven't managed to find a UK broker who will write options (they all seem to be interested in Spread Betting or Warrants), so another reason that US investors have major benefits over UK investors :-(

Best Wishes in both your investing journey and your future family

FI UK

FI UK,

DeleteI typically don't write covered calls because I don't want to risk closing out the position. If I do want to close out or reduce my position but it doesn't necessarily have to be quick then I'll write calls.

Thats surprising that there's not a lot of choices for writing options in the UK. Im sure you can fund one or maybe one of the other bloggers can help you out.

Thanks for stopping by!

Interactive Brokers UK allows you to write options.

ReplyDeleteThanks for the rundown of your strategy. I will probably adopt it soon enough.

ReplyDeleteKeep those premiums coming in!

PIP,

ReplyDeleteThanks for the explanation. I have never used options and probably won't start, but it's nice to know that I could.

KeithX

Thanks for explaining the put option to get better price on stocks. I had to read a few times to really finally get it. I am curious to try it out some day... when I do I will find that post back for sure! ;)

ReplyDeleteThanks for the post! Really valuable information for those of us interested in selling put options. Thanks for sharing the spreadsheet, too!

ReplyDeleteBTW, I've include your blog in my newly compiled blogroll at http://divgro.blogspot.com/p/blogroll.html

Cheers

Ferdi!

Great post PIP. I have never understood how options work and this article definitely helps a bit. Quick question though. In the example you gave with a strike price of $40.50, for the option to execute, does the price have to be below $40.50 on 9/26 (expiration date) or anytime between now and 9/26 or how does that work? If it has to be below the strike price on expiration date, what happens if the price goes up and down the strike price on 9/26?

ReplyDeleteThanks,

DGJ

DGJ,

DeleteIn the US options can be executed at any time once the contract is open. Im not sure of the statistics but I doubt many are ever executed early, probably less than 5% of executed options. At expiration the execution is based off the closing share price of the last trading day for that option. So in the KO $40.50 example if KO is closed at $40.51 the option would just expire but if the share price closed at $40.49 the option would be executed.

As a note I've yet to have an option executed early. And I suspect you'd only see that happen if the share price took a huge dip in price.

Thanks for stopping by!

PIP,

ReplyDeleteNice explanation and this is why I love selling puts. I have a few new trades I need to post for this week. I rolled forward my ESV put and sold a couple GE puts. Everything is so elevated, I'm running out of good ideas for companies I'd actually want to buy. I'm currently watching MO and PM for a good entry though and will likely put in a limit order. I think we both made some nice profits earlier in the year with PM. Anything you are looking at?

Hello PIP,

ReplyDeleteThanks for the article; it was very informative. I have two quick questions that hopefully you could answer:

1. Can you briefly discuss the tax implications of doing this (how is this taxed, are there special tax forms, etc.)? I'm referring to both when you get the income from an unexercised put option that expires and when someone exercises an option that's in the money.

2. Do I understand it correctly that you can really only use this strategy if you're willing to buy at least 100 shares for you dividend portfolio? In your example above, if you only wanted to add 50 shares of Coca Cola to your portfolio, then there's no way that this would work, right? Or is there?

Thanks again.

PIP,

DeleteIt's too bad that you haven't answered my comment in over a week. Of course, you're under no obligation to answer any questions from readers, but I hope you realize that this is one of the key things that makes for a good blog. This is one of the main reasons why I'm a big fan of Dividend Mantra - he always responds to comments in a timely fashion, even if the comments aren't from some big name blog. Hopefully you can now see why your blog will never be as good as that of someone like Dividend Mantra, unless you change this.

Mike

Hi Mike,

DeleteI can only answer point 2. You are right, for almost all options the multiplier is 100. So there is no way to add just 50 KO.

Very good explanation of put selling, and very timely for me. I'm looking to execute my first trade. I was interested in writing a KO option, but the premium just looks too low. I'll probably start with an index based option on the S&P 500 for 1 contract. It requires more capital to be set aside, but for potentially much larger premium. I'm also looking at something a bit more long dated, that gives you slightly more premium. Presumably the $20 KO premium in your example goes up appreciably if it's say 6 months or so out. Do you have any bias to more long dated vs short dated put options?

ReplyDeleteI agree this is a good way to potentially make some money while waiting to buy a stock. But I have a question about how you assess the profitability.....If you sell a put, don't you need to keep enough cash to cover the potential cost? To me, that represents an opportunity cost that you have account for in deciding how much premium to take. That seems like a high hurdle, and I dont usually see high premiums on the kinds of stocks I want to own.

ReplyDeleteAm I looking at this wrong?

I've considered selling puts since you (I thought it was you? Maybe it was AAI) ran a multi-part article on it. I usually don't ever have 4k in capital sitting my account, though. Can you buy partial contracts?

ReplyDelete